Welcome to the first issue of the Penn State Behrend Center for Family Business newsletter for members and interested supporters of the Center. Each issue will feature content intended specifically for family and closely-held businesses in the region of northwestern Pennsylvania.

Each issue will include a Member Spotlight highlighting the family business story of a Center member; a Family Business "Case" about a particular situation that may offer insights of value to our members; an "In the News" section focusing on issues related to family businesses; and contributions from experts in the fields of law, accounting, financial services, strategy development, and others.

If you have a suggestion for content, please reach out to Chris Harben, associate director of the Center for Family Business, at [email protected] or 814-898-6258.

In this Issue:

- Family Business Leadership Development Program

- Peer Groups Up and Running

- Membership Application Now Online

- Buy-Sell Agreement Preserves the Peace

- Spangler Candy Leaders Share Perspectives

- In the News: The "Zombie Tax"

- Negative Tax Treatment of Grantor Trusts

Family Business Leadership Development Program

The Center for Family Business has developed a Family Business Leadership Development Program that will feature four two-hour sessions to run through the month of February. Upon completing the program, participants will have the opportunity to attend exclusive programming offered by the Center.

The program is designed to heighten the skills necessary to lead diverse groups of people within a family business. The content will focus on the application of techniques and gaining an understanding of both change theory and motivation theory.

Regardless of their personality or leadership style, participants can expect to improve their skills through the program, which will highlight successful leadership coaching.

Sessions in the program, which is limited to 20 participants, will be held February 2, 9, 16, and 23. The fee for members of the Center for Family Business is $100. If space is available, non-members can participate for a $600 fee and choose to apply $500 of that fee toward membership in the Center. For questions or to register, contact Dr. Chris Harben, associate director of the Center for Family Business, at [email protected].

Peer Groups Up and Running

A cornerstone of the Center for Family Business is providing members with the opportunity to participate in peer groups.

These are small, professional groups of people who come together to share confidentially and benefit from one another's experience as family or closely-held business owners and leaders. A peer group can serve as an intimate de facto advisory board where participants can learn and grow in their business.

The Center for Family Business' peer groups are kept to a size of approximately 8-10 members and meet monthly. There is a $200 annual fee to participate.

If interested, please contact Chris Harben, associate director of the Center, at [email protected] or 814-898-6258.

Membership Application Now Online

The application for membership in the Center for Family Business is available online and offers the ability to pay via credit card or be invoiced. If you have questions, contact Chris Harben, associate director of the Center, at [email protected] or 814-898-6258.

Access the CFB membership application

Buy-Sell Agreement Preserves the Peace

One of the stories that I think about from time to time involved a client company in Ohio. A homebuilding company, it was owned equally by two brothers who had started the business a few years after the younger of the two had graduated high school. Both brothers had been working in the industry through high school in various capacities.

Over the years, the business grew and became more successful. Both brothers married and started families. Unfortunately, neither brother's wife liked the other. It was not mild dislike either, to the extent that family events had to be coordinated so that the brothers' spouses were never in the same place at the same time. Surprisingly, this had not had an adverse effect on the brothers' relationship.

I met the brothers while I was an investment advisor. Since I was fairly new in the industry, I often ran client situations by colleagues for their thoughts, and in the case of the builder brothers, one of my colleagues brought up what he thought was a major risk exposure for their business. He simply asked me, "What happens if one brother passes away?" The question took me by surprise. That thought hadn't entered my mind.

Both brothers were in their mid-thirties and had been talking to me about retirement investing. The thought of the consequences of one of them passing hadn't occurred to any of us at that point. My colleague had a follow-up question, "Does the wife now become owner of the deceased brother's share? How will THAT work?" The implication was clear. What would be the dynamic in that arrangement? What would happen to the business in that situation?

My colleague's advice was that they consider a "buy-sell agreement." Each brother would buy life insurance on the other. When one brother dies, the other brother would receive the death benefit. The policy would be set up so that the benefit would be sufficient to buy out the shares of the business from the deceased brother's wife. The plan was supported by a legal agreement signed by all parties.

It was a great solution to head off a situation that could have been highly problematic without the right plan. And it was accomplished by the brothers working with a team of trusted advisors.

If your business might be helped by an agreement like the buy-sell arrangement my clients established, please contact us. We may be able to refer you to some Center members who could help.

—Chris Harben, DSL, MBA, CGBP, associate director, Center for Family Business

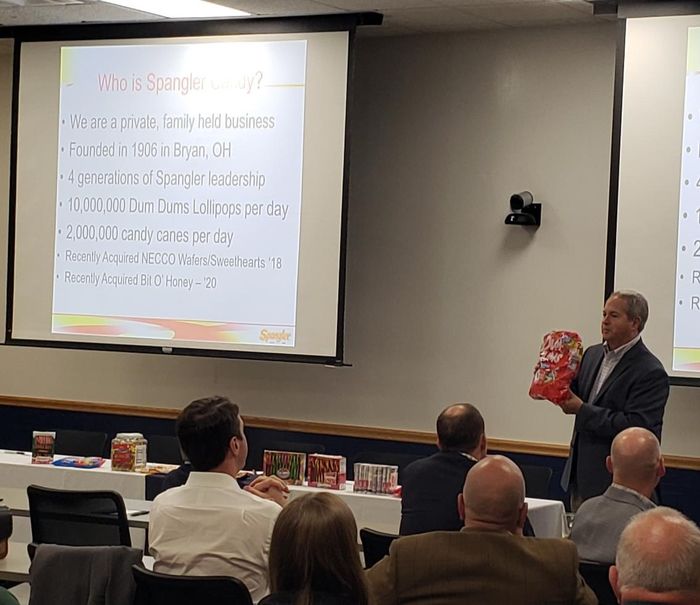

Spangler Candy Leaders Share Perspectives

Kirk Vashaw and Bill Martin from Spangler Candy Company provided the keynote address at the Center for Family Business event, "Your Business, Your Family, Your Legacy," held at Penn State Behrend's Knowledge Park.

Vashaw is a fourth-generation Spangler family member who serves as Chairman and CEO of the company. Martin is the first non-family member to serve as president and also as CFO of the company.

Spangler started in 1906 when Arthur G. Spangler purchased the Gold Leaf Baking Company in Defiance, Ohio, moved the company to nearby Bryan, Ohio (about one hour west of Toledo), and renamed it the Spangler Manufacturing Company. The company soon added candy to its product lineup, and in 1920, became the Spangler Candy Company.

Over the years, Spangler's offerings have evolved from many varieties of chocolate candy to a lineup of mostly hard candies today, the most recognizable brand being the Dum-Dum lollipop. Other Spangler products include Circus Peanuts, Bit-O-Honey, Saf-T-Pops, and, most recently, the Sweethearts and Necco Wafers brands.

Spangler is one of the largest manufacturers of candy canes in the world with licensing agreements to manufacture canes using brands such as Oreos, Skittles, Swedish Fish, Sour Patch, Air Heads, Lifesavers, Starburst, and others. The company just released a new Starburst hard candy lollipop with a chewy candy center.

The company continues to be family-owned, with shareholders extending through multiple generations. According to Vashaw, this has been the result of a strong company culture that maintains close communications among family members.

A key point made by Vashaw at the recent event relates to the "professionalization" of their business. With more than 100 shareholders across the county, but just five family members currently working at Spangler, he said it is critical to their ongoing success to have an established board.

Communication also has been key to this business staying in the family through the years. Family shareholders are welcomed to the plant whenever they like, and contact with shareholders is a continuous focus. This helps maintain the connection with generations that are now relatively far removed from the business.

Vashaw and Martin interacted with members at the wine and cheese reception after the event and ended their day talking with a group of 80 or so Behrend students. They left impressed with the Center and the college, and Behrend students seemed to be energized by the experience.

In the News: The "Zombie Tax"

The "Zombie Tax"—known officially as the "Sensible Taxation and Equity Promotion" (STEP) Act—is a potential threat to family businesses. Now being considered in Congress, the act would change the way assets are taxed upon death.

Currently, when an asset is transferred to heirs upon the death of an owner, any gain in that asset is "stepped up." Heirs inherit the asset without having to pay capital gains tax on the asset that has increased in value.

The STEP Act proposes to impose a capital gains tax on the unrealized gains in the inherited asset. A $1 million exemption would apply. Although experts seem to agree that the bill will not pass in its current form, it is a concern that family businesses are encouraged to monitor.

Negative Tax Treatment of Grantor Trusts

Grantor trusts are recognized for federal estate tax purposes but disregarded for income tax purposes. Grantor trusts allow assets to appreciate outside of the grantor's estate, with the income being taxed to the grantor as opposed to being subject to the compressed income tax brackets of trusts. The plan brings the assets of a grantor trust back into the grantor's taxable estate when the grantor is deemed the owner of the trust.

Currently, a grantor can sell assets (for example, stock in a closely held business) to a grantor trust in exchange for a promissory note, which "freezes" the value of the grantor's estate. Because a grantor trust is disregarded for income tax purposes, there is not a recognition of capital gain on the sale to the trust. The plan seeks to treat the sale between the grantor and the grantor trust the same as if the grantor sold the assets to a third party, meaning that the sale to the grantor trust would likely result in capital gain recognition.

Unlike the change to the estate and gift tax exclusion, the proposed changes to the tax treatment of grantor trusts will become effective immediately upon the proposed legislation being enacted into law. Grantor trusts created and funded prior to the effective date will be grandfathered; however, the trusts cannot be adjusted, and no contributions can be made to the trusts after the proposed legislation is enacted. This is significant because most life insurance trusts are grantor trusts.

Reprinted with permission from the Knox Law Firm, Erie, Pennsylvania. Read the full article online.